NanoVibronix, Inc.

525 Executive BlvdBlvd.

Elmsford, NYNew York 10523

(914) 233-3004

PROXY STATEMENT

FOR

SPECIAL MEETING OF STOCKHOLDERS

To Be Held on , 2019March 31, 2021

Unless the context otherwise requires, references in this proxy statement to “we,“we,” “us,“us,” “our,“our,” “the the “Company” or “NanoVibronix”“NanoVibronix” refer to NanoVibronix, Inc., a Delaware corporation and its consolidated subsidiary as a whole. In addition, unless the context otherwise requires, references to “stockholders” are to the holders of our common stock, par value $0.001 per share.share (“Common Stock”), our Series C Convertible Preferred Stock, par value $0.001 per share (“Series C Preferred Stock”), Series D Convertible Preferred Stock (“Series D Preferred Stock”) and our Series E Convertible Preferred Stock, par value $0.001 per share (“Series E Preferred Stock”).

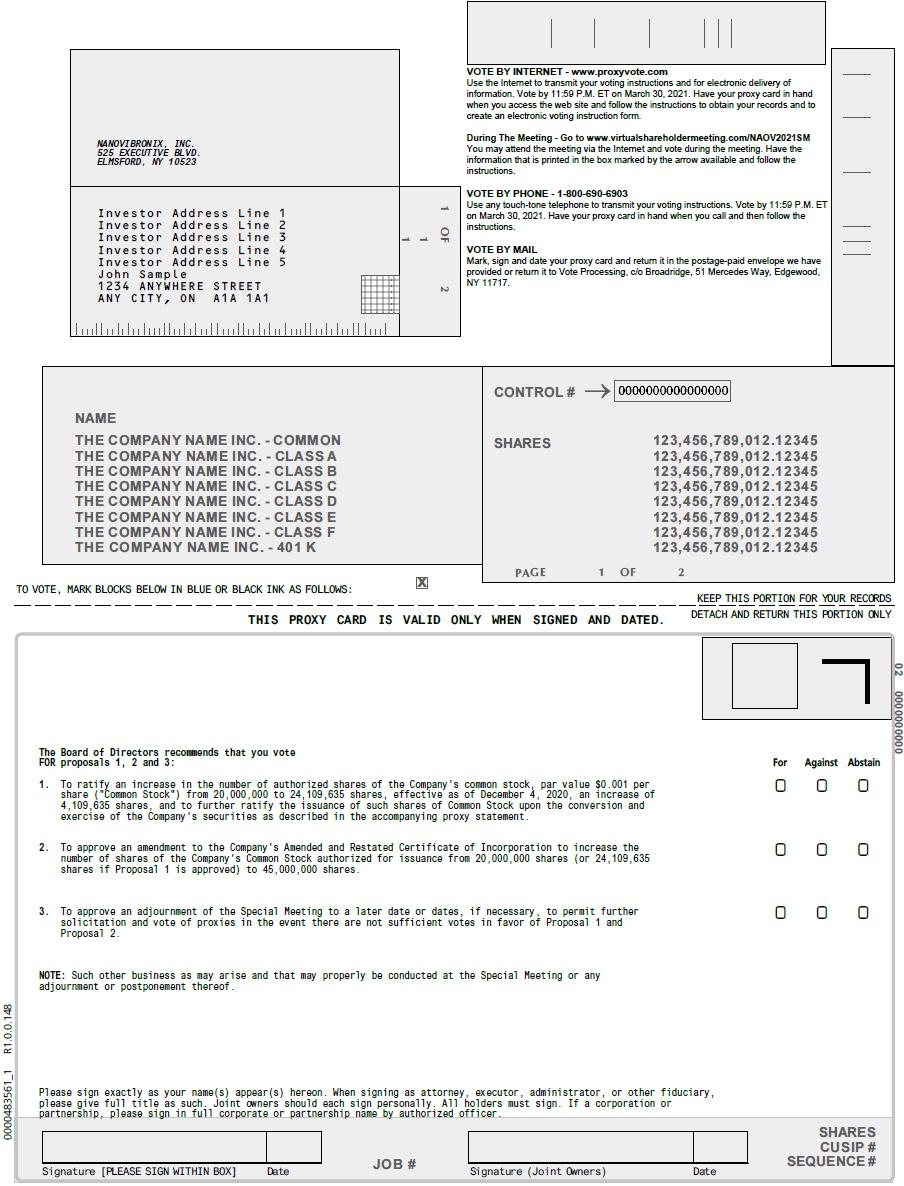

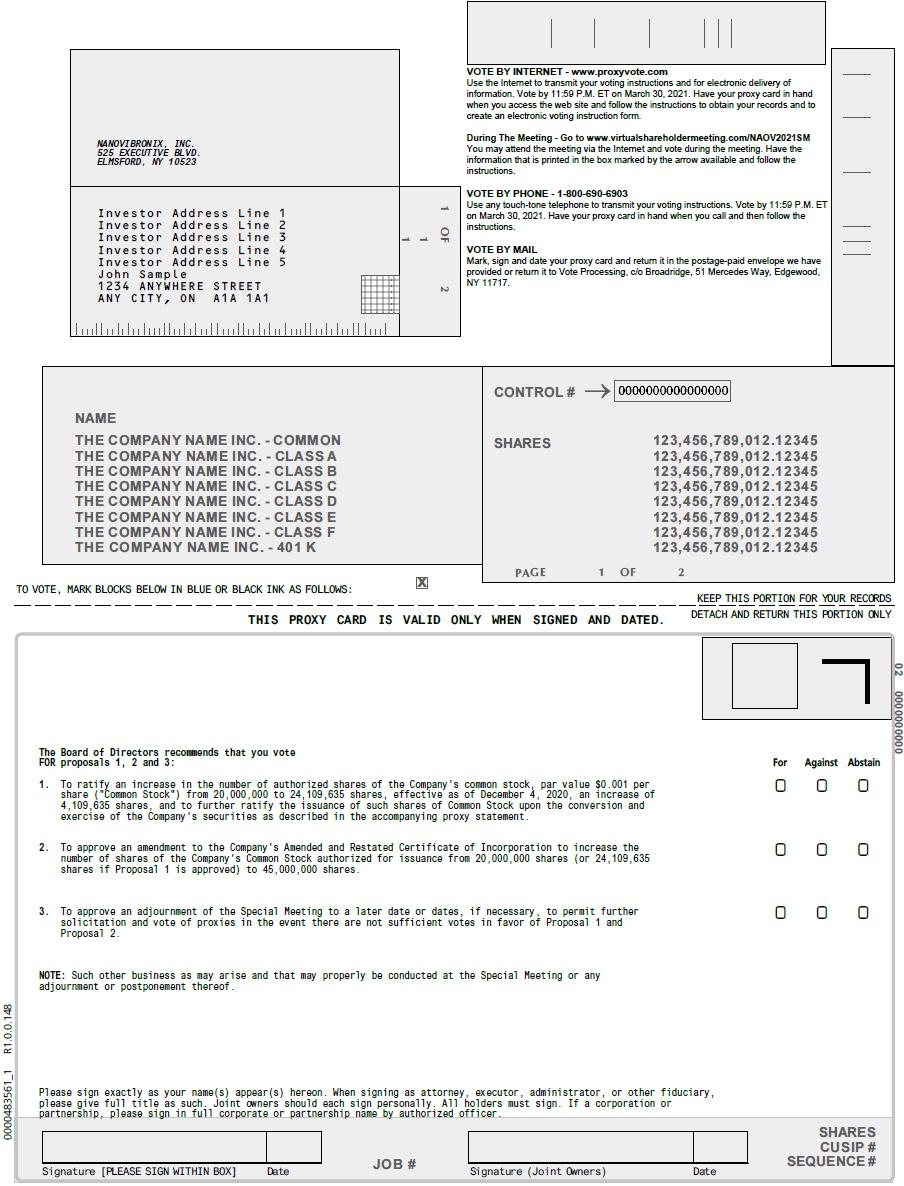

The accompanying proxy is solicited by the Board of Directors (the “Board”“Board”) on behalf of NanoVibronix, Inc. to be voted at a special meetingthe Company’s Special Meeting of stockholders of the CompanyStockholders (the “Special Meeting”“Special Meeting”) to be held on , 2019,March 31, 2021, and at the time and place andany adjournment, continuation or postponement thereof, for the purposes set forth in the accompanying Notice of Special Meeting of Stockholders (the “Notice”“Notice”) and. The Special Meeting will be held virtually via a live webcast on the Internet on March 31, 2021 at any adjournment(s) or postponement(s) of the Special Meeting.10:00 a.m. Eastern time. This proxy statement and accompanying form of proxy are dated , 2019,____________, 2021 and are expected to be first sent given or made availablegiven to stockholders on or about ____________, 2021.

If you held shares of our Common Stock, Series C Preferred Stock or Series E Preferred Stock at the close of business on February 23, 2021 (the “Record Date”), 2019.you are invited to attend the Special Meeting virtually at www.virtualshareholdermeeting.com/NAOV2021SM and vote on the proposals described in this proxy statement.

The executive offices of the Company are located at, and the mailing address of the Company is, 525 Executive Blvd,Blvd., Elmsford, NY 10523.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE STOCKHOLDER MEETING TO BE HELD ON , 2019:The Company will pay the costs of soliciting proxies from stockholders. We have retained Kingsdale Advisors to assist in the solicitation of proxies for a fee of $13,000 plus reimbursement of expenses. In addition to solicitation by mail and by Kingsdale Advisors, our directors, officers and employees may solicit proxies on behalf of the Company, without additional compensation, by telephone, facsimile, mail, on the Internet or in person.

As permitted byImportant Notice Regarding the “Notice and Access” rules of the U.S. Securities and Exchange Commission (the “SEC”), we are making this proxy statement and the proxy card available to stockholders electronically via the Internet at the following website: www.proxyvote.com. On or about , 2019, we began to mail to our stockholders a Notice of Internet Availability of Proxy Materials (the “Noticefor the Special Meeting of Internet Availability”) that contains instructionsStockholders to be Held on how stockholders may access and review allMarch 31, 2021: Pursuant to SEC rules, with respect to the Special Meeting, we have elected to utilize the “full set delivery” option of the proxy materials and how to vote. Also, on or about , 2019, we began mailing printedproviding paper copies of the proxy materials to stockholders that previously requested printed copies. If you received a Notice of Internet Availability by mail, you will not receive a printed copy of the proxy materials in the mail unless you request a copy. If you received a Notice of Internet Availability by mail and would like to receive a printed copyall of our proxy materials you should follow the instructions for requesting such materials included in theby mail. The Notice of Internet Availability.Special Meeting and Proxy Statement are also available at www.proxyvote.com.

QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING

What is a proxy?

A proxy is another person that you legally designate to vote your stock. If you designate someone as your proxy in a written document, that document is also called a “proxy” or a “proxy card.” If you are a “street name” holder, you must obtain a proxy from your broker or nominee in order to vote your shares in person at the Special Meeting.

What is a proxy statement?

A proxy statement is a document that regulations of the SEC require that we give to you when we ask you to sign a proxy card to vote your stock at the Special Meeting.

Why did I receive a Notice of Internet Availability of Proxy Materials instead of paper copies of the proxy materials?

We are using Notice and Access model (“Notice and Access”), which allows us to deliver proxy materials over the Internet, as the primary means of furnishing proxy materials. We believe Notice and Access provides stockholders with a convenient method to access the proxy materials and vote, while allowing us to conserve natural resources and reduce the costs of printing and distributing the proxy materials. On or about , 2019, we began mailing to stockholders a Notice of Internet Availability containing instructions on how to access our proxy materials on the Internet and how to vote online.The Notice of Internet Availability is not a proxy card and cannot be used to vote your shares. If you received a Notice of Internet Availability this year, you will not receive paper copies of the proxy materials unless you request the materials by following the instructions on the Notice of Internet Availability.

What is the purpose of the Special Meeting?

At the Special Meeting, stockholders will act upon the matters outlinedfollowing proposals:

● The ratification of an increase in the Notice, which includenumber of authorized shares of Common Stock from 20,000,000 to 24,109,635, effective as of December 4, 2020, an increase of 4,109,635 shares, and to further ratify the following:issuance of such shares of Common Stock upon the conversion and exercise of the Company’s securities as described in Proposal 1 (the “Share Increase Ratification”);

| (1) | A proposal to approve, in accordance with Nasdaq Marketplace Rule 5635(d), the issuance of (i) shares of the Company’s common stock, par value $0.001 per share, issuable upon the conversion of the Company’s Series E convertible preferred stock, par value $0.001 per share, (ii) and shares of the Company’s common stock issuable upon conversion of the Company’s Series E Preferred Stock issuable upon exercise of warrants, in each case, issued in private placement offerings on June 21, 2019 and July 31, 2019 (“Proposal One”). |

| | |

| (2) | A proposal to approve, in accordance with Nasdaq Marketplace Rule 5635(c), the issuance of (i) shares of the Company’s common stock and (ii) shares of our common stock issuable upon exercise of warrants, in each case, to a director of the Company (“Proposal Two”). |

| | |

| (3) | A proposal to approve an amendment of the Company’s Amended and Restated Certificate of Incorporation to increase the authorized preferred stock of the Company from 5,000,000 shares to 11,000,000 shares (“Proposal Three”). |

| (4) | A proposal to approve an adjournment of the Special Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of Proposal One, Proposal Two and/or Proposal Three (“Proposal Four”). |

● The approval of an amendment to our Amended and Restated Certificate of Incorporation to increase the number of shares of our Common Stock authorized for issuance from 20,000,000 (or 24,109,635 if Proposal 1 is approved) shares to 45,000,000 shares (the “Amendment Proposal”); and

What should I do● The approval of an adjournment of the Special Meeting to a later date or dates, if I receive more than one setnecessary, to permit further solicitation and vote of voting materials?proxies in the event there are not sufficient votes in favor of any of the Share Increase Ratification and the Amendment Proposal (the “Adjournment Proposal”).

You may receive more than one Notice of Internet Availability (or, if you requested a printed copyThe Share Increase Ratification is being submitted to our stockholders pursuant to Section 204 of the proxy materials,Delaware General Corporate Law, or DGCL, and Delaware common law. The Notice and this proxy statement (including the resolutions adopted by the Company’s Board attached to this proxy statement as Appendix Aand the text of Sections 204 and 205 of the DGCL attached to this proxy card) or voting instruction card. For example, if you hold your sharesstatement as Appendix B) constitute the notice required to be given to our stockholders under Section 204 of the DGCL in more than one brokerage account, you will receive a separate voting instruction card for each brokerage account in which you hold shares. Similarly, if you are a stockholderconnection with the Share Increase Ratification and is being delivered to stockholders of record (both voting and hold shares in a brokerage account, you will receive a Noticenon-voting) as of Internet Availability (or, if you requested a printed copyDecember 4, 2020, other than those whose identities or addresses cannot be determined from our records. However, such holders of our Common Stock, Series C Preferred Stock, Series D Preferred Stock and Series E Preferred Stock are not entitled to virtually attend the Special Meeting or vote on any matter presented at the Special Meeting unless they were also holders of stock as of the proxy materials,Record Date (as defined below).

Under Sections 204 and 205 of the DGCL, when a proxy card)matter is submitted for shares heldratification at a stockholders meeting, any claim that a defective corporate act ratified under Section 204 is void or voidable due to the failure of authorization or that the Delaware Court of Chancery should determine, in your nameits discretion, that a ratification in accordance with Section 204 of the DGCL not be effective or be effective only on certain conditions, must, in either case, be brought within 120 days from the time a certificate of validation is filed with the secretary of state of the State of Delaware and becomes effective in accordance with the DGCL. The Company expects to file a voting instruction cardcertificate of validation for shares held in “street name.” Please following the separate voting instructionsShare Increase Ratification that you received for youris approved by our stockholders promptly after the Special Meeting. Accordingly, if the Share Increase Ratification is approved at the Special Meeting, any claim that the effectiveness of the increase to the number of authorized shares of our common stock heldCommon Stock and the issuance of such shares of Common Stock upon the conversion and exercise of the Company’s securities as described in eachthe accompanying proxy statement is void or voidable due to a failure of your different accountsauthorization with respect to ensuresuch increase or that all your shares are voted.the Delaware Court of Chancery should declare, in its discretion, that such Share Increase Ratification not be effective or be effective only on certain conditions, must, in either case, be brought within 120 days from both the time at which a certificate of validation is filed with respect to such Share Increase Ratification and such time as such certificate of validation becomes effective under the DGCL (which, with respect to the Share Increase Ratification, will be the applicable “validation effective time” as set forth in the Share Increase Ratification).

What is the record date and what does it mean?

The record date to determine the stockholders entitled to notice of and to vote at the Special Meeting is the close of business on , 2019February 23, 2021 (the “Record Date”“Record Date”). The Record Date is established by the Board as required by Delaware law. On the Record Date, 24,109,625 shares of our common stockCommon Stock were issued and outstanding. On the Record Date, 666,667 shares of our Series C Convertible Preferred Stock (the “Series C Preferred Stock”) were issued and outstanding and after application of the beneficial ownership limitation pursuant to the termsholder of the Series C Preferred Stock as set forthis entitled to 666,667 votes on the proposals described in this proxy statement. On the certificateRecord Date, 875,000 shares of designation forSeries E Preferred Stock were issued and outstanding and the holder of the Series CE Preferred Stock certain holders of Series C Preferred Stock areis entitled to an aggregate of495,751 votes on the proposals described in this proxy statement. See “What are the voting rights of the stockholders?” below.

Who is entitled to vote at the Special Meeting?

Holders of our common stockCommon Stock, the Series C Preferred Stock, and ourthe Series CE Preferred Stock, subject to the beneficial ownership limitation, at the close of business on the Record Date may vote at the Special Meeting.

In connection with the Share Increase Ratification, stockholders of record as of December 4, 2020 (both voting and non-voting), other than holders whose identities or addresses cannot be determined from our records, are receiving notice of the Special Meeting under Section 204 of the DGCL. However, such holders of our Common Stock, Series C Preferred Stock, Series D Preferred Stock and Series E Preferred Stock as of December 4, 2020 are not entitled to virtually attend the Special Meeting or vote on any matter presented at the Special Meeting unless they were a stockholder of record as of the Record Date.

What are the voting rights of the stockholders?

The Company has twothree classes of voting stock, common stockCommon Stock, Series C Preferred Stock and Series CE Preferred Stock. Each holder of common stockCommon Stock is entitled to one vote per share of common stockCommon Stock on each matter to be acted upon at the Special Meeting. Each holder of Series C Preferred Stock is entitled to the number of votes equal to the number of whole shares of common stockCommon Stock into which the shares of Series C Preferred Stock held by such holder are then convertible (subject to the 9.99% beneficial ownership limitations) with respect to any and all matters presented to the stockholders for their action or consideration. Each holder of Series E Preferred Stock is entitled to the number of votes equal to the number of our Common Stock equal to the Voting Ratio (subject to the 9.99% beneficial ownership limitations) with respect to any and all matters presented to the stockholders for their action or consideration. The Voting Ratio, for each share of Series E Preferred Stock, is equal to $2.00 divided by $3.53. Fractional votes are not, however, permitted and any fractional voting rights resulting from the above formula (after aggregating all shares into which shares of Series E Preferred Stock held by each Series E Preferred Stock holder could be converted) shall be rounded to the nearest whole number (with one-half being rounded upward). Holders of Series C Preferred Stock and Series E Preferred Stock vote together with the holders of common stockCommon Stock as a single class, except as provided by law and except that the consent of holders of a majority of the outstanding Series C Preferred Stock or Series E Preferred Stock is required to amend the terms of the Series C Preferred Stock.Stock or Series E Preferred Stock, respectively. Holders of our common stockCommon Stock, Series C Preferred Stock and Series CE Preferred Stock will vote together as a single class on all matters described in this Proxy Statement.proxy statement.

When and where is the Special Meeting and what do I need to be able to attend online?

The presence, in person or by proxy, of the holders of a majority of the voting power of the issued and outstanding shares of common stock andSpecial Meeting will be held on February 23, 2021, at 10:00 a.m. Eastern time at www.virtualshareholdermeeting.com/NAOV2021SM. Any stockholder who owns our Common Stock, Series C Preferred Stock, Series D Preferred Stock or Series E Preferred Stock on the Record Date can attend the Special Meeting online.

You will be able to attend the Special Meeting online, vote, view the list of stockholders entitled to vote at the Special Meeting is necessary to constitute a quorum to transact business. If a quorum is not present or represented atand submit your questions during the Special Meeting by visiting www.virtualshareholdermeeting.com/NAOV2021SM. To participate in the Chairman ofvirtual meeting, you will need a 16-digit control number included on your proxy card or voting instruction form, as applicable. The meeting webcast will begin promptly at 10:00 a.m. Eastern time. We encourage you to access the meeting may adjournprior to the start time and you should allow ample time for the check-in procedures. Because the Special Meeting will be a completely virtual meeting, from timethere will be no physical location for stockholders to time to another place, if any, date or time.attend.

What is the difference between a stockholder of record and a “street name” holder?

If your shares are registered directly in your name with V-Stock Transfer LLC, the Company’s stock transfer agent, you are considered the stockholder of record with respect to those shares. The proxy statement and proxy card have been sent directly to you by the Company.

If your shares are held in a stock brokerage account or by a bank or other nominee, the nominee is considered the record holder of those shares. You are considered the beneficial owner of these shares, and your shares are held in “street name.” The proxy statement and the proxy card have been forwarded to you by your nominee. As the beneficial owner, you have the right to direct your nominee concerning how to vote your shares by using the voting instructions the nominee included in the mailing or by following such nominee’s instructions for voting.

How do I votecast my shares?vote?

If you are a stockholder of record, holder, you may vote your shares at the Special Meeting in person or by proxy. To vote in person, you must attend the Special Meeting and obtain and submit a ballot. The ballot will be provided at the Special Meeting. To vote by proxy, you may choose one of the following methodsthere are four ways to vote your shares:vote:

| | ●(1) | ViaBy Internet: as prompted by the menu found at www.proxyvote.com follow the instructions to obtain24 hours a day, seven days a week, until 11:59 p.m. Eastern time on March 30, 2021 (have your records and submit an electronic ballot. Please have your Stockholder Control Number,16-digit stockholder control number, which can be found on your proxy card, in hand when you access this voting site. You may vote via the Internetwebsite); |

| | |

| (2) | By toll-free telephone at 1-800-690-6903, until 11:59 p.m., Eastern Time,time on , 2019. |

| ● | Via telephone: call 1-800-690-6903 and then follow the voice instructions. Please haveMarch 30, 2021 (have your Stockholder Control Number,16-digit stockholder control number, which can be found on your proxy card, in hand when you call. You may vote by telephone until 11:59 p.m., Eastern Time, on , 2019.call); |

| | ● | Via mail: You may vote by proxy by |

| (3) | By completing, signing, dating and promptly returning the enclosedmailing your proxy card in the postage-paid envelope. Ifenvelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717; or |

| | |

| (4) | Online during the Special Meeting at www.virtualshareholdermeeting.com/NAOV2021SM. You will need your 16-digit stockholder control number, which can be found on your proxy card, in hand when you submit a signed proxy without indicating your vote online during the person voting the proxy will vote your shares according to the Board’s recommendation.Special Meeting. |

The proxy is fairly simple to complete, with specific instructions on the electronic ballot, telephone or card. By completing and submitting it,a proxy, you will direct the designated persons (known as “proxies”) to vote your stock at the Special Meeting in accordance with your instructions. The Board has appointed Brian Murphy, our chief executive officer and director and James Cardwell, our Chief Financial Officer,Stephen Brown to serve as the proxies for the Special Meeting.

In order to be counted, proxies submitted by telephone or Internet must be received by 11:59 p.m. Eastern time on March 30, 2021. Proxies submitted by U.S. mail must be received before the start of the Special Meeting.

Your proxy will be valid only if you complete and return it before the Special Meeting. If you properly complete and transmitvoted according to your proxy but do not provide voting instructions with respect to a proposal, then the designated proxies will vote your shares “FOR” each proposal as to which you provide no voting instructions. We do not anticipate that any other matters will come before the Special Meeting, but if any other matters properly come before the meeting, then the designated proxies will vote your shares in accordance with applicable law and their judgment.

If you hold your shares in “street name,” your bank, broker or other nominee should provide to you a request for voting instructions along with the Company’s proxy solicitation materials. By completing the voting instruction card, you may direct your nominee how to vote your shares. If you partially complete the voting instruction but fail to complete one or more of the voting instructions, then your nominee may be unable to vote your shares with respect to the proposal as to which you provide no voting instructions. See “What is a broker non-vote?” Alternatively, if you want to vote your shares in person at the Special Meeting, you must contact your nominee directly in order to obtain a proxy issued to you by your nominee holder. Note that a broker letter that identifies you as a stockholder is not the same as a nominee-issued proxy.If you fail to bring a nominee-issued proxy to the Special Meeting, you will not be able to vote your nominee-held shares in person at the Special Meeting.

Who counts the votes?

All votes will be tabulated by Brian Murphy, the inspector of election appointed for the Special Meeting. Each proposal will be tabulated separately.

Can I vote my shares in person at the Special Meeting?

Yes. If you are a stockholder of record you may vote your shares at the meeting by completing a ballot at the Special Meeting.

If you hold your shares in “street name,” you may vote your shares in person only if you obtain a proxy issued by your bank, broker or other nominee giving you the right to vote the shares.

Even if you currently plan to attend the Special Meeting, we recommend that you also return your proxy or voting instructions as described above so that your votes will be counted if you later decide not to attend the Special Meeting or are unable to attend.

What is a broker non-vote?

Broker non-votes occur when shares are held indirectly through a broker, bank or other intermediary on behalf of a beneficial owner (referred to as held in “street name”) and the broker submits a proxy but does not vote for a matter because the broker has not received voting instructions from the beneficial owner and (i) the broker does not have discretionary voting authority on the matter or (ii) the broker chooses not to vote on a matter for which it has discretionary voting authority.

With respect to the to the proposal to approve an amendment of the Company’s Amended and Restated Certificate of Incorporation to increase the authorized preferred stock of the Company from 5,000,000 shares to 11,000,000 shares (Proposal 3), your broker will have the discretion to vote your shares and, therefore, will be able to vote your shares with respect to such proposals even if you do not provide your broker with instructions on those proposals.

If I am a beneficial owner of shares, can my brokerage firm vote my shares?

If you are a beneficial owner and do not vote via the Internet or telephone or by returning a signed voting instructionproxy card, to your broker, your shares maywill not be voted only with respect to so-called “routine” matters whereunless you virtually attend the Special Meeting and vote your broker has discretionary voting authority over your shares. Under the rules of the New York Stock Exchange (“NYSE”), which apply to brokers regardless of whether an issuer is listed on the NYSE or NASDAQ, only Proposal Three is a “routine” matter. Accordingly, brokers will have discretionary authority to vote only on Proposal Three.

shares online. If you are a beneficial owner and do not vote via the Internet or telephone and do not specify contrary voting instructions, your shares will be voted in accordance with the recommendations of our Board on all matters, and in the discretion of proxy holders as to any other matters that may properly come before the meeting or by returning a signedany adjournment, continuation or postponement thereof. Similarly, if you sign and submit your proxy card or voting instruction card to your broker, your broker will not be permitted to votewith no instructions, your shares will be voted in accordance with respectthe recommendations of our Board on all matters, and in the discretion of proxy holders as to Proposal One, Proposal Twoany other matters that may properly come before the meeting or Proposal Four, as underany adjournment, continuation or postponement thereof. We know of no other business to be considered at the rulesSpecial Meeting.

If your shares are registered in the name of the NYSE these proposals are “non-routine.” If a broker, holding shares returns an executed proxy card that indicates thatbank or other nominee (typically referred to as being held in “street name”), there are four ways to vote:

| (1) | By Internet at www.proxyvote.com 24 hours a day, seven days a week, until 11:59 p.m. Eastern time on March 30, 2021 (have your 16-digit stockholder control number, which can be found on your voting instruction form, in hand when you access the website); |

| | |

| (2) | By toll-free telephone at 1-800-454-8683, until 11:59 p.m. Eastern time on March 30, 2021 (have your 16-digit stockholder control number, which can be found on your voting instruction form, in hand when you call); |

| | |

| (3) | By completing, signing, dating and mailing your voting instruction form in the postage-paid envelope provided to you; or |

| (4) | Online during the Special Meeting at www.virtualshareholdermeeting.comNAOV2021SM. You will need your 16-digit shareholder control number, which can be found on your voting instruction form, in hand when you vote online during the Special Meeting. |

In the broker hasevent you do not received voting instructions with respect to Proposal One, Proposal Two or Proposal Four, then such shares will not be considered to have been voted on such proposal. Your broker will vote your shares on Proposal One, Proposal Two and Proposal Four only if you provide instructions on how to vote, by following the instructions, they provide to you. Accordingly, we encourage youyour broker will have authority to vote promptly, even ifyour shares. Under the rules that govern brokers who are voting with respect to shares that are held in street name, brokers have the discretion to vote such shares on “routine” matters, but not on “non-routine” matters. The NYSE has informed us that each of the Share Increase Ratification, the Amendment Proposal and the Adjournment Proposal is a “routine” matter. Accordingly, your broker, bank or other nominee may vote your shares without receiving instructions from you planon Proposal 1 (Share Increase Ratification), Proposal 2 (Amendment Proposal) and Proposal 3 (Adjournment Proposal). A failure to attend the Special Meeting.

We encourage youinstruct your broker, bank or other nominee on how to provide instructions to your brokerage firm via the Internet or telephone or by returning your signed voting instruction card. This ensures thatvote your shares will be voted atnot necessarily count as a vote against the Special Meeting with respect to all of the proposals described in this Proxy Statement.proposal.

Can I changeWhat are my vote?

Yes. If you are a record holder, you may revoke your proxy at any time by any of the following means:choices when voting?

| | ●When you cast your vote on: |

| Attending | | |

| | Proposal 1: | You may vote FOR the Special Meetingproposal, AGAINST the proposal or ABSTAIN. |

| | | |

| | Proposal 2: | You may vote FOR the proposal, AGAINST the proposal or ABSTAIN. |

| | | |

| | Proposal 3: | You may vote FOR the proposal, AGAINST the proposal or ABSTAIN. |

How does the Board recommend I vote on the proposals?

The Board recommends you vote:

● “FOR” the Share Increase Ratification;

● “FOR” the Amendment Proposal; and

● “FOR” the Adjournment Proposal.

What is a “quorum?”

A quorum is the minimum number of shares required to be present or represented by proxy at the Special Meeting to properly hold a meeting of stockholders and conduct business under our bylaws and Delaware law. The presence, in person or by proxy, of a majority of the voting power of all issued and outstanding shares of our Common Stock, Series C Preferred Stock and Series E Preferred Stock entitled to vote on the Record Date will constitute a quorum at the Special Meeting. Abstentions, withheld votes, and broker non-votes will be counted as shares present and entitled to vote for the purposes of determining a quorum for the Special Meeting. “Broker non-votes” occur when brokers, banks or other nominees that hold shares on behalf of beneficial owners do not receive voting instructions from the beneficial owners prior to the meeting and do not have discretionary voting authority to vote those shares; however, as discussed above, all proposals currently scheduled to be considered at the Special Meeting are “routine,” and accordingly, we do not expect any broker non-votes.

What vote is required to approve each item?

| The following table sets forth the voting in person. Your attendance atrequirement with respect to each of the Special Meeting will not by itself revoke a proxy. You must vote your shares by ballot at the Special Meeting to revoke your proxy.proposals: |

| | ●Proposal 1 — Share Increase Ratification. | Completing | To be approved by stockholders, this proposal must receive the affirmative “FOR” vote of the holders of a majority of the shares of Common Stock, Series C Preferred Stock (subject to beneficial ownership limitations) and submitting a new valid proxy bearing a later date.Series E Preferred Stock (subject to beneficial ownership limitations) outstanding. |

| | ● | Giving written notice | |

| Proposal 2 – Amendment Proposal. | | To be approved by stockholders, this proposal must receive the affirmative “FOR” vote of revocationthe holders of a majority of the shares of Common Stock, Series C Preferred Stock (subject to beneficial ownership limitations) and Series E Preferred Stock (subject to beneficial ownership limitations) outstanding. |

| | | |

| Proposal 3 – Adjournment Proposal. | | To be approved by stockholders, this proposal must receive the Company addressed to Brian Murphy, our Chief Executive Officeraffirmative “FOR” vote of a majority of votes cast “FOR” and a director,“AGAINST” the matter at the Company’s address above, which notice must be received before 12:00 p.m. New York time on , 2019.Special Meeting. |

If youHow are a “street name” holder, your bank,abstentions and broker or other nominee should provide instructions explaining how you may change or revoke your voting instructions.non-votes treated?

How many votes are needed to approve each proposal?

Approval of Proposal One Proposal requires the affirmative voteEach of the holders offailure to vote by proxy or to vote in person (which would include voting online at the virtual Special Meeting), an abstention and a majoritybroker non-vote will have the same practical effect as a vote against the Share Increase Ratification and Amendment Proposal. Each of the shares of common stock and Series C Preferred Stock (subjectfailure to the 9.99% beneficial ownership limitations) casting votesvote by proxy or to vote in person or by proxy on such proposal(which would include voting online at the virtual Special Meeting. Under Delaware law, abstentions are not counted as “votes cast.” Accordingly, abstentions will not be counted toward the vote total for this proposalMeeting), an abstention and a broker non-vote will have no effect on the Adjournment Proposal. As described above, the NYSE has informed us that each of the Share Increase Ratification, Amendment Proposal and the Adjournment Proposal is a “routine” matter. Accordingly, your broker, bank or other nominee may vote your shares without receiving instructions from you on this proposal. If you own shares through an intermediary, you mustProposal 1 (Share Increase Ratification), Proposal 2 (Amendment Proposal) and Proposal 3 (Adjournment Proposal) and we do not expect any broker non-votes. A failure to instruct your broker, bank broker or other holder of recordnominee on how to vote in order for them to vote your shares so that yourwill not necessarily count as a vote can be counted with respect to this proposal. Broker non-votes will have no effect onagainst the vote on this proposal.

Approval of Proposal Two requiresCan I revoke or change my proxy?

You may revoke your proxy and change your vote at any time before the affirmativefinal vote of the holders of a majority of the shares of common stock and Series C Preferred Stock (subject to the 9.99% beneficial ownership limitations) casting votes in person or by proxy on such proposal at the Special Meeting. Under Delaware law, abstentions are not counted as “votes cast.” Accordingly, abstentions will not be counted towardYou may vote again on a later date via the vote total for this proposal and will have no effect on the vote on this proposal. If you own shares through an intermediary, you must instructInternet or by telephone (only your bank, brokerlatest Internet or other holder of record how to vote in order for them to vote your shares so that your vote can be counted with respect to this proposal. Broker non-votes will have no effect on the vote on this proposal.

Approval of Proposal Three requires the affirmative vote of the holders of a majority of the shares of our common stock and Series C Preferred Stock (subjecttelephone proxy submitted prior to the 9.99% beneficial ownership limitations) outstanding as of the record date, voting as one class. Abstentions will have the effect of a vote “AGAINST” this proposal. ThereSpecial Meeting will be no broker non-votescounted), by signing and returning a proxy card or voting instructions form with respect to this proposal.

Approval of Proposal Four requires the affirmative vote of the holders of a majority of the shares casting votes in personlater date, or by proxy on such proposalattending the Special Meeting and voting via the virtual meeting website. However, your attendance at the Special Meeting (assuming a quorum is present). Under Delaware law, abstentions are not counted as “votes cast.” Accordingly, abstentions will not be counted towardautomatically revoke your proxy unless you vote again at the vote total for this proposal and will have no effect on the vote on this proposal. If you own shares through an intermediary, you must instruct your bank, brokerSpecial Meeting or other holder of record how to vote in order for them to vote your shares sospecifically request that your vote can be counted with respectprior proxy is revoked by delivering to this proposal. Broker non-votes will have no effect on the vote on this proposal.

How doesCompany’s corporate secretary at 525 Executive Blvd., Elmsford, NY 10523, a written notice of revocation prior to the Board recommend that I vote?

The Board recommends that you vote:

| ● | “FOR” Proposal One – A proposal to approve, in accordance with Nasdaq Marketplace Rule 5635(d), the issuance of (i) shares of our common stock issuable upon the conversion of the Series E Preferred Stock, and (ii) shares of our common stock issuable upon conversion of the Series E Preferred Stock issuable upon exercise of warrants, in each case, issued in private placement offerings on June 21, 2019 and July 31, 2019. |

| ● | “FOR” Proposal Two – A proposal to approve, in accordance with Nasdaq Marketplace Rule 5635(c), the issuance of (i) shares of our common stock and (ii) shares of our common stock issuable upon exercise of warrants, in each case, to a director of the Company. |

| ● | “FOR” Proposal Three – A proposal to approve an amendment of the Company’s Amended and Restated Certificate of Incorporation to increase the authorized preferred stock of the Company 5,000,000 shares to 11,000,000 shares. |

| ● | “FOR” Proposal Four – A proposal to approve an adjournment of the Special Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of Proposal One, Proposal Two and/or Proposal Three.

|

What if I do not specify how I want my shares voted?

If you are a record holder who returns a completed proxy that does not specify how you want to vote your shares on one or more proposals, the proxies will vote your shares for each proposal as to which you provide no voting instructions, and such shares will be voted in the following manner:

If you are a “street name” holder and do not provide voting instructions on one or more proposals, your bank, broker or other nominee will be unable to vote those shares with respect to Proposal One, Proposal Two and Proposal Four. See “What is a broker non-vote?”

Special Meeting.

Do I have any dissenters’ or appraisal rights with respect to any of the matters to be voted on at the Special Meeting?

No. None of ourthe stockholders has any dissenters’ or appraisal rights with respect to the matters to be voted on at the Special Meeting.

What are the solicitation expenses and who pays the costdoes it mean if I get more than one set of this proxy solicitation?voting materials?

Our Board is askingYour shares are probably registered in more than one account. Please provide voting instructions for yourall proxy and we will pay all of the costs of asking for stockholder proxies. We will reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding solicitation material to the beneficial owners of common stock and collecting voting instructions. We may use officers and employees of the Company to ask for proxies, as described below.instruction cards you receive.

Is this proxy statement the only way that proxies are being solicited?Whom do I call if I have questions?

No. In additionIf you have any questions, need additional material, or need assistance in voting your shares, please feel free to contact the firm assisting us in the solicitation of proxies, by use of the Notice of Internet Access, officers and employees of the Company may solicit the return of proxies, either by mail, telephone, telecopy, e-mail or through personal contact. These officers and employees will not receive additional compensation for their efforts but will be reimbursed for out-of-pocket expenses. Brokerage housesKingsdale Advisors. Brokers, banks and other custodians, nominees and fiduciaries, in connection with shares of the common stock registered in their names, will be requested to forward solicitation material to the beneficial owners of shares of common stock.may call 416-867-2272. Stockholders may call toll-free 1-877-657-5856. Or you may contact Kingsdale Advisors by email at contactus@kingsdaleadvisors.com.

Are there any other matters to be acted upon at the Special Meeting?

Management does not intend to present any business at the Special Meeting for a vote other than the matters set forth in the Notice and has no information that others will do so. If other matters requiring a vote of the stockholders properly come before the Special Meeting, it is the intention of the persons named in the form of proxy to vote the shares represented by the proxies held by them in accordance with applicable law and their judgment on such matters.

Is my vote kept confidential?

Proxies, ballots and voting tabulations identifying stockholders are kept confidential and will not be disclosed to third parties except as may be necessary to meet legal requirements.

Where can I find the voting results of the Special Meeting?

We will announceThe preliminary voting results will be announced at the Special Meeting. We expect to publishThe final voting results will be published in a Current Report on Form 8-K to be filed by us with the SEC within four business days followingof the Special Meeting.meeting.

PROPOSAL 1

Who can help answer my questions?Ratification of the Increase in Authorized Shares of Common Stock

and the Issuance of Common Stock Upon Conversion of the Series C Preferred Stock

and the Exercise of Certain December 2021 Warrants and the Pre-Existing Warrants

Our Board has determined that it is in the best interests of the Company and our stockholders to ratify, pursuant to Section 204 of the DGCL, the increase in the number of authorized shares of our Common Stock from 20,000,000 shares to 24,109,635 shares and the issuance of 4,109,635 shares of Common Stock upon conversion of certain shares of Series C Preferred Stock (as described below) and the exercise of certain December 2021 Warrants and Pre-Existing Warrants (as described below). This ratification will be retroactive to December 4, 2020, the date of the first such overissue.

Background

As of December 3, 2020, we had 20,000,000 authorized shares of our Common Stock and 19,850,014 shares of Common Stock outstanding resulting in 149,986 shares of Common Stock being available for issuance.

On December 4, 2020, certain holders of our Series C Preferred Stock converted 396,509 shares of Series C Preferred Stock into 396,509 shares of Common Stock, resulting in an overissue of 246,523 shares of Common Stock, as more particularly described in Exhibit A to the resolutions adopted by our Board attached to this proxy statement as Appendix A.

Beginning on December 15, 2020, through January 22, 2021, certain holders of warrants we had issued in December 2020 (the “December 2020 Warrants”) exercised a portion of the December 2020 Warrants for 2,657,144 shares of Common Stock, resulting in an additional overissue of 2,657,144 shares of Common Stock, as more particularly described in Exhibit B attached to Appendix A of this proxy statement.

On January 22, 2020, a holder of warrants we have previously issued in various offerings (the “Pre-Existing Warrants”) exercised a portion of the Pre-Existing Warrants for 1,205,968 shares of Common Stock, resulting in an additional overissue of 1,205,968 shares of Common Stock, as more particularly described in Exhibit C attached to Appendix A of this proxy statement. The aggregate number of shares of Common Stock that has been overissued by the Company is 4,109,635.

Our Board, in consultation with counsel, has determined that it is in the best interests of the Company and our stockholders to ratify an increase in the number of authorized shares of the Company’s Common Stock from 20,000,000 to 24,109,635, an increase of 4,109,635 shares (the “Authorized Share Increase”), and the issuance of 4,109,635 shares of Common Stock (the “Authorized Share Increase Issuance”) upon the conversion of certain shares of Series C Preferred Stock and the exercise of certain December 2020 Warrants and Pre-Existing Warrants pursuant to Section 204 of the DGCL to eliminate any uncertainty related to the effectiveness of the issuance of such putative shares of Common Stock. If the Share Increase Ratification is approved by our stockholders and becomes effective, the ratification will be retroactive to December 4, 2020, which was the date of the first such overissue.

Among other consequences, the Share Increase Ratification will confirm that, since December 4, 2020, all of the 4,259,621 shares of Common Stock issued upon conversion of the Series C Preferred Stock and the exercise of the December 2020 Warrants and the Pre-Existing Warrants will have been duly authorized and validly issued.

Our Board Has Approved the Share Increase Ratification and the Authorized Share Increase Issuance

Section 204 of the DGCL allows a Delaware corporation, by following specified procedures, to ratify a corporate act retroactive to the date the corporate act was originally taken. Our Board determined that it would be advisable and in the best interests of the Company and our stockholders to ratify the Authorized Share Increase and Authorized Share Increase Issuance, each as described in this Proposal 1, pursuant to Section 204 of the DGCL and Delaware common law in order to eliminate any uncertainty related to the due authorization and validity of such shares of Common Stock and unanimously adopted the resolutions attached hereto as Appendix A (such resolutions are incorporated herein by reference) approving the Share Increase Ratification. Our Board also recommended that our stockholders approve the Share Increase Ratification for purposes of Section 204 of the DGCL and Delaware common law, and directed that the Share Increase Ratification be submitted to our stockholders for approval.

The text of sections 204 and 205 of the DGCL are attached hereto as Appendix B.

Filing of a Certificate of Validation

Upon the receipt of the required vote of the stockholders to approve the Share Increase Ratification, we intend to file a certificate of validation with respect to the Authorized Share Increase and the Authorized Share Increase Issuance with the Secretary of State of the State of Delaware (the “Certificate of Validation”). The time that the filing of the Certificate of Validation with the Secretary of State of the State of Delaware becomes effective in accordance with the DGCL will be the validation effective time of the Share Increase Ratification within the meaning of Section 204 of the DGCL.

Retroactive Ratification of the Authorized Share Increase and the Authorized Share Increase Issuance

Subject to the 120-day period for bringing claims discussed below, when the Certificate of Validation becomes effective in accordance with the DGCL, it should eliminate any possible uncertainty as to whether the shares of Common Stock issued in the Authorized Share Increase Issuance are void or voidable as a result of the potential failure of authorization described above, and the effect of the ratification will be retroactive to December 4, 2020, which was the date of the first such overissue.

Time Limitations on Legal Challenges to the Ratification of the Authorized Share Increase and the Authorized Share Increase Issuance

If the Share Increase Ratification becomes effective, under the DGCL, any claim that (i) the Authorized Share Increase or the Authorized Share Increase Issuance ratified pursuant to the Share Increase Ratification is void or voidable due to a failure of authorization, or (ii) the Delaware Court of Chancery should declare in its discretion that the Share Increase Ratification not be effective or be effective only on certain conditions, must be brought within 120 days from the time that the filing of the Certificate of Validation with the Secretary of State of the State of Delaware becomes effective in accordance with the DGCL.

The information provided above in this “Question and Answer” formatConsequences if the Share Increase Ratification is for your convenience only andNot Approved by the Stockholders

If the Share Increase Ratification is merely a summarynot approved by the requisite vote of stockholders, we will not be able to file the Certificate of Validation with the Secretary of State of the information containedState of Delaware and the Share Increase Ratification will not become effective in this proxy statement. We urge you to carefully read this entire proxy statement, including the documents we refer to in this proxy statement. If you have any questions, or need additional materials, please feel free to contact Brian Murphy by email at bmurphy@nanovibronix.com or phone at 914-233-3004.

What is “householding” and how does it affect me?

With respect to eligible stockholders who share a single address, we may send a single copyaccordance with Section 204 of the proxy materialsDGCL. The failure to approve the Share Increase Ratification may leave us exposed to potential claims that address unless(i) the past issuances of our Common Stock since December 4, 2020 may not be valid; (ii) the Company does not have sufficient authorized but unissued shares of Common Stock to permit future sales and issuances of Common Stock, including pursuant to outstanding shares of preferred stock, warrants and equity awards; and (iii) we received instructionswould not be able to validate our total outstanding shares of Common Stock in connection with any strategic transaction that our Board may determine is advisable, including, without limitation, a sale of the contrary from any stockholder at that address. This practice, known as “householding,” is designedCompany, a business combination or merger, or a license or other disposition of corporate assets of the Company. Any inability to reduce our printing and postage costs. However, if a stockholder of record residing at such address wishes to receive a separate proxy statement and other proxy materialsissue Common Stock in the future heand any invalidity of past issuances of Common Stock could expose us to significant claims and have a material adverse effect on our liquidity, which could result in our filing for bankruptcy or she may contact us by mail at NanoVibronix, Inc., 525an involuntary petition for bankruptcy being filed against us.

Interests of Directors and Executive Blvd, Elmsford, NY 10523, Attn: Brian MurphyOfficers

Our directors and executive officers have no substantial interests, directly or by calling 914-233-3004 and asking for Brian Murphy. Eligible stockholdersindirectly, in the matters set forth in this Proposal 1 except to the extent of record receiving multiple copiestheir ownership of shares of our Common Stock and equity awards granted to them under our equity incentive plans.

Vote Required

The affirmative “FOR” vote of the holders of a majority of the outstanding shares of our Common Stock, Series C Preferred Stock (subject to beneficial ownership limitations) and Series E Preferred Stock (subject to beneficial ownership limitations) is required to approve this proposal. Each of the failure to vote by proxy materials can request householding by contacting usor to vote in person (which would include voting online at the virtual Special Meeting), an abstention and a broker non-vote will have the same manner. Stockholders who ownpractical effect as shares throughvoted against this proposal. The NYSE has informed us that a vote on this proposal will be a “routine” matter. Therefore, we do not expect any broker non-votes on this proposal and a failure to instruct your broker, bank broker or other nominee can request householding by contacting such nominee.on how to vote your shares will not necessarily count as a vote against this proposal.

We hereby undertake to deliver promptly, upon written or oral request,Board Recommendation

Our Board of Directors recommends a copyvote “FOR” the Share Increase Ratification.

PROPOSAL 2

Approval of the proxy materialsAmendment to Our Amended and Restated Certificate of Incorporation

to Increase the Number of Authorized Shares of Common Stock

Proposed Amendment

Our authorized capital stock presently consists of 20,000,000 shares of common stock, par value $0.001 per share (“Common Stock”) and 5,000,000 shares of preferred stock, par value $0.001 per share. If the Share Increase Ratification as described in Proposal 1 is approved, the number of authorized shares of Common Stock will increase to 24,109,635 shares.

Our Board has approved, and is recommending to the stockholders for approval at the Special Meeting, an amendment to our Amended and Restated Certificate of Incorporation to increase the number of authorized shares of Common Stock. The proposed amendment would increase the number of authorized shares of Common Stock from 20,000,000 (or 24,109,635 if Proposal 1 is approved) shares to 45,000,000 shares. The number of authorized shares of preferred stock would not be affected by the proposed amendment. If approved, the first sentence of Article Fourth of our Amended and Restated Certificate of Incorporation will be amended to read in its entirety as follows:

“FOURTH. The total number of shares of all classes of stock which the Corporation shall have the authority to issue is fifty-six million (56,000,000), consisting of forty-five million (45,000,000) shares of Common Stock, par value $0.001 per share (the “Common Stock”) and eleven million (11,000,000) shares of preferred stock, par value of $0.001 per share (“Preferred Stock”).”

The additional shares of our Common Stock for which authorization is sought will have the same voting rights, the same rights to dividends and distributions, and will be identical in all other respects to the shares of our Common Stock now authorized.

Reasons for the Proposed Amendment

As discussed in Proposal 1, we have issued shares of our Common Stock in excess of the number of our currently authorized shares of Common Stock. Accordingly, we have no shares of Common Stock currently available for issuance. As of February 23, 2021, 9,006,548 shares of Common Stock were reserved for issuance or issuable upon conversion of outstanding shares of preferred stock or exercise of outstanding warrants and equity awards. We currently do not have a sufficient number of authorized shares of Common Stock available for such future issuances.

If the Amendment Proposal is approved, assuming Proposal 1 is approved and taking into account the number of shares of Common Stock reserved for issuance or issuable upon conversion of outstanding shares of preferred stock or exercise of outstanding warrants and equity awards, our Board will have the authority to issue approximately 11,883,817 additional shares of Common Stock without further stockholder approval, except as may be required for a particular transaction by applicable law or regulation or by any securities exchange on which our shares of Common Stock are listed.

The additional shares of Common Stock may be used for such corporate purposes as may be determined by our Board from time to time to be necessary or desirable. These purposes may include: (i) issuance of Common Stock upon conversion or exercise of our outstanding securities as described above, (ii) raising capital through the sale of Common Stock or other securities convertible into or exchangeable or exercisable for Common Stock, (iii) acquiring other businesses or assets in exchange for Common Stock or other securities convertible into or exchangeable or exercisable for Common Stock, (iv) attracting and retaining employees by the issuance of additional securities under the Company’s equity compensation plans and agreements and (v) other corporate purposes.

Our Board believes that the authorized number of shares of Common Stock should be increased to provide our Board of Directions with the ability to issue additional shares of Common Stock for the corporate purposes described above without potentially having to incur the delay and expense incident to obtaining special stockholder approval each time an opportunity requiring the issuance of shares of our Common Stock may arise. Such a delay might cause us to lose an opportunity or make it more expensive for us to take advantage of an opportunity. Although our Board has no present plans to issue any additional shares of Common Stock, except in connection with our outstanding convertible preferred stock, our existing equity awards and incentive plans or as required upon exercise of our outstanding warrants, the Board believes that the proposed increase in the number of authorized shares of Common Stock is necessary to provide us with the necessary flexibility to pursue corporate opportunities.

Possible Effects of the Proposed Amendment

The authorization of additional shares of Common Stock sought by this proposal would not have any immediate dilutive effect upon the proportionate voting power or rights of our existing stockholders; however, to the extent that the additional authorized shares of Common Stock are issued in the future, such issuance may decrease existing stockholders’ percentage equity ownership and, depending upon the price of which they are issued, could be dilutive to existing stockholders and have a negative effect upon the market price of the Common Stock. Our stockholders do not have preemptive rights, which means they do not have the right to purchase shares in any future issuance of Common Stock in order to maintain their proportionate ownership of Common Stock.

The amendment to increase the number of authorized shares of our Common Stock could have the effect of discouraging or preventing attempts to take over control of the Company. For example, in the event of a hostile attempt to take over control of the Company, it may be possible for us to impede the attempt by issuing shares of Common Stock, which would dilute the voting power of the other outstanding shares and increase the potential cost to acquire control of us. The proposed amendment therefor may have the effect of discouraging unsolicited takeover bids and potentially limiting the opportunity for our stockholders to dispose of their shares at a shared addresspremium which may otherwise be available in a takeover attempt or merger proposal. To the extent that it impedes any such attempts, the proposed amendment may serve to which a single copyperpetuate our current management, including our Board. The amendment is not being proposed in response to any known effort or threat to acquire control of the document was delivered. Requests should be directedCompany and is not part of a plan by management to Brian Murphyadopt a series of amendments to our Amended and Restated Certificate of Incorporation and bylaws having an anti-takeover effect.

If the proposed amendment is adopted, it will become effective upon filing of a Certificate of Amendment to our Amended and Restated Certificate of Incorporation with the Secretary of State of Delaware.

Vote Required

The affirmative “FOR” vote of the holders of a majority of the outstanding shares of our Common Stock, Series C Preferred Stock (subject to beneficial ownership limitations) and Series E Preferred Stock (subject to beneficial ownership limitations) is required to approve this proposal. Each of the failure to vote by proxy or to vote in person (which would include voting online at the addressvirtual Special Meeting), an abstention and a broker non-vote will have the same practical effect as shares voted against this proposal. The NYSE has informed us that a vote on this proposal will be a “routine” matter. Therefore, we do not expect any broker non-votes on this proposal and a failure to instruct your broker, bank or phone number set forth above.other nominee on how to vote your shares will not necessarily count as a vote against this proposal.

Board Recommendation

Our Board recommends that you vote “FOR” the Amendment Proposal.

PROPOSAL 3

The Adjournment Proposal

The Company is asking its stockholders to approve an adjournment of the Special Meeting from time to time, if necessary or appropriate, to permit further solicitation of proxies and vote of proxies in the event there are not sufficient votes in favor of Proposal 1 (Share Increase Ratification) or Proposal 2 (Amendment Proposal) (the “Adjournment Proposal”).

Vote Required

The affirmative “FOR” vote of a majority of the votes cast “FOR and “AGAINST” the matter at the Special Meeting is required to approve this proposal. Each of the failure to vote by proxy or to vote in person (which would include voting online at the virtual Special Meeting), an abstention and a broker non-vote will have no effect on the voting results for the Adjournment Proposal. The NYSE has informed us that a vote on this proposal will be a “routine” matter. Therefore, we do not expect any broker non-votes on this proposal and a failure to instruct your broker, bank or other nominee on how to vote your shares will not necessarily count as a vote against this proposal.

Board Recommendation

Our Board recommends that you vote “FOR” the Adjournment Proposal.

STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information with respect to the beneficial ownership of our common stockCommon Stock as of August 20, 2019February 23, 2021 by:

| | ● | each person known by us to beneficially own more than 5.0% of our common stock;Common Stock; |

| | |

| | ● | each of the named executive officers;officers identified in the “Summary Compensation Table” under “Executive Compensation” in the Company’s definitive proxy statement filed with the SEC on June 15, 2020; and |

| | |

| | ● | all of our directors and executive officers as a group. |

The percentages of common stockCommon Stock beneficially owned are reported on the basis of regulations of the Securities and Exchange CommissionSEC governing the determination of beneficial ownership of securities. Under the rules of the Securities and Exchange Commission,SEC, a person is deemed to be a beneficial owner of a security if that person has or shares voting power, which includes the power to vote or to direct the voting of the security, or investment power, which includes the power to dispose of or to direct the disposition of the security.

Except as indicated in the footnotes to this table, each beneficial owner named in the table below has sole voting and sole investment power with respect to all shares beneficially owned and each person’s address is c/o NanoVibronix, Inc., 525 Executive Blvd, Elmsford, NY 10523. As of August 20, 2019,February 23, 2021, we had 4,429,96424,109,635 shares of common stock, 2,733,142Common Stock, 666,667 shares of Series C Preferred Stock, par value $0.001 per share (“Series C Preferred Stock”), 304154 shares of Series D Preferred Stock par value $0.001 per share (the “Series D Preferred Stock”), and 1,810,000875,000 shares of Series E Preferred Stock, par value $0.001 per share (the “Series E Preferred Stock”), outstanding. In addition to the shares of our common stockCommon Stock reported below, as described in the footnotes below the table, six stockholdersone stockholder beneficially ownowns 100% of our issuable and issued Series C Preferred Stock and one stockholder beneficially owns 100% of our issuable and issued Series E Preferred Stock.

| Name of Beneficial Owner | | Number of

Shares

Beneficially

Owned (1) | | Percentage

of Shares

Outstanding (1) | | | Number of Shares Beneficially Owned (1) | | Percentage of Shares Outstanding (1) | |

| 5% Owners | | | | | | | | | | | | | |

| IDT Corporation(2) | | | 438,566 | (3) | | | 9.9 | % | |

| Paul Packer(4) | | | 438,566 | (5) | | | 9.9 | % | |

| Bespoke Capital LLC (6) | | | 275,000 | | | | 6.2 | % | |

| Orin Hirschman(7) | | | 438,566 | (8) | | | 9.9 | % | |

| Kennedy Capital Management, Inc.(9) | | | 317,775 | (10) | | | 7.2 | % | |

| Officers and Directors | | | | | | | | | |

| | | | | | | | | | |

| Paul Packer (2) | | | | 2,244,916 | (3) | | | 8.7 | % |

| Shavit 2, LLC (4) | | | | 1,750,000 | (5) | | | 6.8 | % |

| Directors and Officers | | | | | | | | | |

| Stephen Brown | | | | 70,000 | (6) | | | * | |

| Harold Jacob, M.D. | | | 225,773 | (11) | | | 4.9 | % | | | 221,487 | (7) | | | 1.0 | % |

| | | | | | | | | | |

| Martin Goldstein, M.D. | | | 154,417 | (12) | | | 3.4 | % | | | 76,500 | (8) | | | * | |

| Michael Ferguson | | | 88,750 | (13) | | | 2.0 | % | | | 96,500 | (9) | | | * | |

| Thomas R. Mika | | | 94,583 | (14) | | | 2.1 | % | | | 106,000 | (10) | | | * | |

| Christopher Fashek | | | 113,759 | (15) | | | 2.5 | % | | | 140,000 | (11) | | | 1.0 | % |

| Brian Murphy | | | 212,519 | (16) | | | 4.6 | % | | | 130,000 | (12) | | | 1.0 | % |

| All directors and executive officers as a group (9 persons) | | | 885,515 | | | | 16.9 | % | |

| All directors and executive officers as a group (7 persons) | | | | 840,487 | | | | 3.4 | % |

* Represents ownership of less than 1%.

| | (1) | Shares of common stockCommon Stock beneficially owned and the respective percentages of beneficial ownership of common stockCommon Stock assume the exercise of all options, warrants and other securities convertible into common stockCommon Stock beneficially owned by such person or entity currently exercisable or exercisable within 60 days of March 31, 2019.February 23, 2021. Shares issuable pursuant to the exercise of stock options and warrants exercisable within 60 days are deemed outstanding and held by the holder of such options or warrants for computing the percentage of outstanding common stockCommon Stock beneficially owned by such person, but are not deemed outstanding for computing the percentage of outstanding common stockCommon Stock beneficially owned by any other person. |

| | |

| | (2) | IDT Corporation’s address is 520 Broad Street, Newark, New Jersey 07102. |

| (3) | Comprised of (i) 155,838 shares of common stock, (ii) 270,353 shares of common stock that may be issued upon the conversion of an equal number of shares of Series C Preferred Stock held by a subsidiary of IDT Corporation and (iv) 12,375 shares of common stock that may be issued upon the conversion of an equal number of shares of Series C Preferred Stock held by IDT Corporation. Does not include 383,939 shares of Series C Preferred Stock, which IDT Corporation also holds. These shares of Series C Preferred Stock are excluded, even though the terms of the Series C Preferred Stock allow for conversion into common stock and voting on an as if converted basis with the common stock, because these rights are prohibited if their exercise will result in the holder having beneficial ownership of more than 9.99% of our common stock. Does not include 533,334 shares of common stock that may be purchased by IDT Corporation upon the exercise of warrants. These shares of common stock are excluded because the warrants contain provisions that block exercise if such exercise will result in the holder having beneficial ownership of more than 9.99% of our common stock. |

| (4) | Mr. Packer’s address is 805 Third Avenue, 15th Floor, New York, NY 10022. |

| | (5) | Based on information contained in Schedule 13G filed on February 14, 2019, |

| (3) | Comprised of (i) 78,157 shares of common stock owned by Paul Packer, 276,359 shares of common stock owned by Globis Capital Partners, L.P., and comprised298,087 shares of 30,286common stock owned by Globis Asia L.P and (ii) 30,000 shares of common stock that may be purchased upon the exercise of stock options held by Mr. Packer and 408,280 shares of common stock beneficially owned or common stock issuable upon conversion of Series C Preferred Stock, Series D Convertible Preferred Stock or Series E Convertible Preferred Stock beneficially owned by Globis Capital Partners, L.P., Globis International Investments L.L.C., Globis Asia, L.P., AYTA Consulting, LLC, Shavit 2 Partners LLC or Mr. Packer. |

Does not include certain shares of (i) common stock issuable upon conversion of Series C Preferred Stock, Series D Convertible Preferred Stock, and Series E Convertible Preferred Stock (ii) common stock that may be purchased upon exercise of the warrants to purchase common stock or (iii) common stock issuable upon conversion of Series C Preferred Stock and Series E Preferred Stock that may be purchased upon exercise of the warrants to purchase preferred stock held by Globis Capital Partners, L.P., Globis International Investments L.L.C., Globis Asia, L.P., AYTA Consulting, LLC, Shavit 2 Partners LLC or Mr. Packer, which Mr. Packer also beneficially owns. These shares of common stock issuable upon conversion of the Series C Preferred Stock and Series E Preferred Stock are excluded, even though the terms of the Series C Preferred Stock and the Series E Preferred Stock allow for conversion into common stock and voting on an as if converted basis with the common stock, because these rights are prohibited if the exercise of such conversion or voting rights will result in the holder having beneficial ownership of more than 9.99% of the issuer’s common stock. These shares of common stock issuable upon conversion of the Series D Convertible Preferred Stock are excluded because the terms of the Series D Convertible Preferred Stock contain provisions that block conversion if such conversion will result in the holder having beneficial ownership of more than 9.99% of our common stock. These shares of common stock that may be purchased upon warrants to purchase common stock or preferred stock are excluded because the warrants and the terms of the preferred stock contain provisions that block exercise if such exercise will result in the holder having beneficial ownership of more than 9.99% of our common stock.

Mr. Packer is the managing member of Globis Capital Advisors, L.L.C., which is the general partner of Globis Capital Partners, L.P. Mr. Packer is the managing member of Globis Capital, L.L.C., which is the general partner of Globis Capital Management, L.P., which is the investment manager of Globis Capital Partners, L.P. Mr. Packer is also the managing member of Globis International Investments L.L.C., and Globis Asia LP. Mr. Packer is deemed to have beneficial ownership of the shares held by Globis Capital Partners, L.P., Globis Asis LP. and Globis International Investments L.L.C. Mr. Packer also controls, and is deemed to have beneficial ownership of the shares held by, AYTA Consulting, LLC and Shavit 2 Partners, LLC.

| (6) | Bespoke Growth Partners Inc’s address is 3300 N.E. 188th St. LPH 17 Aventura Fl. 33180. |

| (7) | Mr. Hirschman’s address is 6006 Berkeley Avenue, Baltimore, Maryland 21209. |

| (8) | Based on information contained in Schedule 13G filed on February 15, 2019. Comprised of (i) 5,911 shares of common stock held by Mr. Hirschman, (ii) 1,299(iii) 58,258 shares of common stock that may be purchased upon the exercise of stock warrants held by Mr. Hirschman, (iii) 70,803 shares of common stock held by AIGH Investment Partners LLC, of which Mr. Hirschman serves as president,(iv) 314,860 shares of common stock held by AIGH Investment Partners L.P., of which Mr. Hirschman serves as general partner, and (v) 45,593 shares of common stock beneficially owned or common stock issuable upon conversion of Series C Preferred Stock, Series D Convertible Preferred Stock or Series E Convertible Preferred Stock beneficially owned by AIGH Investment Partners |

Does not include 37,890 shares of Series C Convertible Preferred Stock held by AIGH Investment Partners, L.P., 344,407 shares of Series E Convertible Preferred Stock held by AIGH Investment Partners, L.P., 27,500 shares of Series E Convertible Preferred Stock held by WVP Emerging Manager Offshore Fund LLC and 82,500 shares of Series E Convertible Preferred Stock held by Emerging Manager Onshore Fund LLC which have been excluded because the shares contain provisions that block conversion if such conversion will result in the holder having beneficial ownership of more than 9.9% of our common stock.

Does not include 558,752 shares of common stock that may be purchased by AIGH Investment Partners, L.P., 30,000 shares of common stock that may be purchased by WVP Emerging Manager Offshore Fund LLC and 90,000 shares of common stock that may be purchased by Emerging Manager Onshore Fund LLC upon the exercise of warrants, which have been excluded because the warrants contain provisions that block exercise if such exercise will result in the holder having beneficial ownership of more than 9.9% of our common stock. These shares of common stock are excluded because the warrants contain provisions that block exercise if such exercise will result in the holder having beneficial ownership of more than 9.9% of our common stock.

Mr. Hirschman is the managing member of AIGH Investment Partners, L.P. and is deemed to have beneficial ownership of the shares held by WVP Emerging Manager Offshore Fund LLC and Emerging Manager Onshore Fund LLC.

| (9) | Kennedy Capital Management, Inc.’s address is 10829 Olive Blvd. St. Louis, MO 63141. |

| (10) | Based on information contained in Schedule 13G filed on February 13, 2018. Does not include 159,199Packer, 1,205,968 shares of common stock that may be purchased by Kennedy Capital Management, Inc. upon the exercise of stock warrants which have been excluded becauseheld by Globis Capital Partners, L.P., and 298,087 shares of common stock that may be purchased upon the exercise of stock warrants contain provisions that block exercise if such exercise will result in the holder having beneficial ownership of more than 4.99% of our common stock.

held by Globis Asia L.P. |

| | (11) | |

| (4) | Shavit 2, LLC’s address is 805 Third Avenue, 15th Floor, New York, NY 10022. |

| | |

| (5) | Comprised of 875,000 shares of common stock issuable upon conversion of 875,000 Series E preferred stock owned and 875,000 shares of common stock that that may be purchased upon the exercise of stock warrants. |

| | |

| (6) | Comprised of 70,000 shares of stock that may be purchased by Mr. Brown upon exercise of stock options that are currently exercisable or exercisable within 60 days following February 23, 2021. |

| | |

| (7) | Comprised of (i) 64,178 shares of common stockCommon Stock held by Medical Instrument Development Inc., an entity controlled by Dr. Jacob, (ii) 25,66212,362 shares of common stockCommon Stock held by Dr. Jacob, and (iii) 154,417119,285 shares of common stockCommon Stock that may be purchased by Dr. Jacob upon the exercise of stock options. |

| | (12) | |

| (8) | Comprised of 154,41776,500 shares of common stock that may be purchased by Dr. Goldstein upon exercise of stock options that are currently exercisable or exercisable within 60 days.days following February 23, 2021. |

| | (13)(9) | Comprised of 88,75096,500 shares of common stock that may be purchased by Mr. Ferguson upon exercise of stock options that are currently exercisable or exercisable within 60 days.days following February 23, 2021. |

| | (14) | |

| (10) | Comprised of 94,583106,000 shares of common stock that may be purchased by Mr. Mika upon exercise of stock options that are currently exercisable or exercisable within 60 days.days following February 23, 2021. |

| | (15) | |

| (11) | Comprised of 113,75925,000 shares of commonCommon Stock held by Mr. Fashek and 140,000 shares of stock that may be purchased by Mr. Fashek upon exercise of stock options that are currently exercisable or exercisable within 60 days.days following February 23, 2021. |

| | (16) | |

| (12) | Comprised of 212,519130,000 shares of common stock that may be purchased by Mr. Murphy upon exercise of stock options that are currently exercisable or exercisable within 60 days. |

PROPOSAL ONE

A PROPOSAL TO APPROVE, IN ACCORDANCE WITH NASDAQ MARKETPLACE RULE 5635(D), THE ISSUANCE OF (II) SHARES OF OUR COMMON STOCK ISSUABLE UPON THE CONVERSION OF THE SERIES E CONVERTIBLE PREFERRED STOCK, AND (II) SHARES OF OUR COMMON STOCK ISSUABLE UPON CONVERSION OF THE SERIES E PREFERRED STOCK ISSUABLE UPON EXERCISE OF WARRANTS, IN EACH CASE, ISSUED IN PRIVATE PLACEMENT OFFERINGS ON JUNE 21, 2019 AND JULY 31, 2019

General Description of Proposal

The stockholders of the Company are being asked to approve, in accordance with Nasdaq Marketplace Rule 5635(d), the issuance of (i) shares of our common stock issuable upon the conversion of the Series E Preferred Stock, and (ii) shares of our common stock issuable upon conversion of the Series E Preferred Stock issuable upon exercise of warrants, in each case, issued in private placement offerings on June 21, 2019 and July 31, 2019.

Description of the Offerings

On June 21, 2019, we entered into and closed a private placement Securities Purchase Agreement with certain existing stockholders relating to the sale to such existing stockholders of 1,600,000 shares of our Series E Preferred Stock, and seven year warrants to purchase 1,600,000 shares of our Series E Preferred Stock at an exercise price of $2.50 per share, at a purchase price per unit of $2.00 (the “June Offering”), for aggregate gross proceeds of $3,200,000 (excluding the exercise of the warrants issued in the June Offering).

On July 31, 2019, we entered into and closed a private placement Securities Purchase Agreement with certain existing stockholders relating to the sale to such existing investors of 210,000 shares of our Series E Preferred Stock and seven year warrants to purchase 210,000 shares of our Series E Preferred Stock at an exercise price of $2.50 per share, at a purchase price per unit of $2.00 (the “July Preferred Offering”), for gross proceeds of $420,000 (excluding the exercise of the warrants issued in the July Preferred Offering).

On July 31, 2019, we entered into and closed a private placement Securities Purchase Agreement with certain accredited investors relating to the sale to such investors of 290,000 shares of our common stock, and seven year warrants to purchase 290,000 shares of our common stock at an exercise price of $2.50 per share, at a purchase price per unit of $2.00 (the “July Common Offering), for gross proceeds of $580,000 (excluding the exercise of the warrants issued in the July Common Offering).